Accessing Super for All-on-4® Dental Implants in Australia

5 minute read

Missing teeth can cause a number of problems, impacting on health, self-esteem and quality of life. Replacing missing teeth with All-on-4® dental implants can improve function and appearance, but it is also a significant investment. If cost is a barrier to restoring your smile, one option could be to apply for the early release of superannuation funds – keeping in mind that this could affect your retirement income in the future.

If you want to know more about accessing your super fund for dental implants, read this guide to find out about the process, eligibility requirements and the pros and cons. Our dentists in Kelmscott can provide information about the process and connect you with a trusted early super access provider.

What is early release of super funds?

Superannuation programmes help to ensure your financial stability after employment ends by building and managing a retirement fund. In some circumstances, fund providers may grant early access to these funds before retirement, but this is considered a last resort option when other sources of finance aren’t available.

Early super access may be approved only if there is a justified reason for the expense and if you don’t have any other means of covering the costs, such as using savings or taking out a loan. One such reason is the release of super funds on compassionate grounds. This may be granted if you or a family member need a medical or dental treatment for a problem that’s causing acute pain, chronic pain or mental distress.

Missing or failing teeth and their impact on health and wellbeing may be considered grounds for compassionate early release of superannuation and may be an option for funding a dental implant treatment.

Am I eligible for early super release?

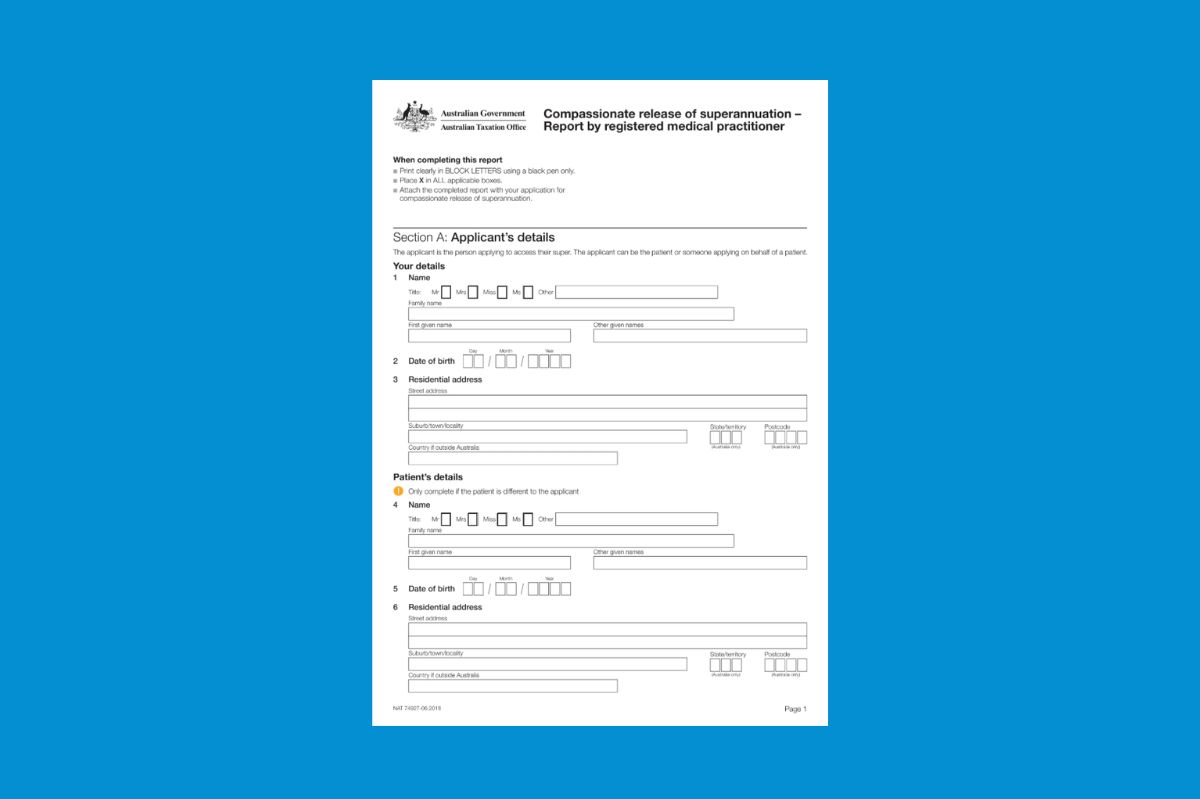

Eligibility for the compassionate release of super funds is decided on a case by case basis, but you will first need to:

• Be a citizen or permanent resident of Australia or New Zealand

• Have signed documents from two medical professionals explaining your condition

• Not have other means of covering your treatment costs

It’s also possible to apply for early release of funds to support a dependant who needs treatment.

To find out whether early super release is an option for you, call our team at Kelmscott Dental today on (08) 9495 7999 to discuss your options and learn more about how to apply.

How much can I withdraw?

The ATO will set the limit of how much you can withdraw from your super fund, depending on your needs. You can choose to cover all of your expenses with your super payment, or cover part of your All-on-4® treatment costs through other means and only need to withdraw a smaller amount.

It’s strongly recommended to only withdraw the minimum amount you need, as any withdrawal from your superannuation could impact on your future finances. A financial advisor can help you to understand the impact of an early withdrawal in the long-term.

What fees are involved?

Charges for making early super withdrawals can vary, depending on whether you apply to the ATO directly or through a service provider. There are also tax implications, depending on your age, which need to be taken into account.

• If you apply for early release of funds through a service provider, there will be a fee. Super Health Ensemble charges a service fee of $660, which is competitive with other services. There is no charge when applying to the ATO directly, but the application process can be overwhelming for individuals.

• If you are below retirement age, you will be charged tax on compassionate release of super funds at your marginal tax rate. The tax rate to be paid is 20-25% on top of the treatment estimate.

• There won’t be any charges if your application is not approved by the ATO.

How to apply

If you decide you want to access your super funds early, you can apply directly with your super fund and the Australian Taxation Office (ATO) or through an application management service. The latter involves a service fee, but it can make the process more straightforward and could improve your chance of a successful application by making sure everything is done correctly.

The steps involved in applying for and receiving funding are:

1. Discussion with your dentist to determine whether you may be eligible for compassionate release of super funds.

2. Collecting documents about your treatment needs signed and dated by your All-on-4® dentist and your regular general doctor.

3. Submitting your application and supporting documents to the ATO and waiting for their decision.

4. If early access is approved, communicating with your super fund to arrange the release of funds to your dentist.

At Kelmscott Dental, we work with Super Health Ensemble to help our patients apply for early super release. They will work with you on your application to make sure everything is included and contact your super fund on your behalf.

It can take up to 4 weeks for a super release to be approved, with possible delays if the ATO needs more information.

How much do All-on-4® implants cost?

The total cost of All-on-4® implants varies depending on the material of the implant bridge, whether you’re replacing one or both arches of teeth and other factors, such as any additional services provided.

At Kelmscott Dental, All-on-4® dental implants start from $21,000 per arch or $40,000^ for both arches. This price is indicative only and includes:

• 4 Nobel Biocare NobelParallel™ dental implants per jaw

• 4 Xeal™ TiUltra™ titanium abutments per jaw

• Digitally-milled titanium-reinforced high-quality acrylic bridge

• Clinical radiographs (excluding 3D CBCT scan)

• Follow-up appointments for 6 months

• 5-year warranty# on titanium implants and bar

• 2-year warranty# on acrylic bridge

Your dentist will provide a comprehensive quote detailing the full cost of your treatment prior to you starting the process with an early super access provider or making your application to the ATO, who may approve the release of super funds to cover your full or partial treatment costs.

^The total cost of All-on-4® treatment varies according to whether additional components such as extra implants, longer implants or bone grafting is required to achieve the desired outcome. Additional costs such as tooth removal, sedation & hospital costs may also apply. All-on-4® requires ongoing maintenance costs such as professional cleaning, x-rays, bridge replacements and repairs as needed.

#Warranty is subject to attending implant reviews, six-monthly check-ups and hygiene maintenance appointments.

Nobel Biocare’s All-on-4® protocol is the most-researched treatment option for full arch restoration worldwide, with a 98% success rate supported by clinically-proven studies.* Titanium implants can often last a lifetime with good care, while an implant bridge will usually need to be replaced after a number of years.

* Malo P, de Araújo Nobre M, Lopes A, Moss SM, Molina GJ. A longitudinal study of the survival of All-on-4® implants in the mandible with up to 10 years of follow-up. J Am Dent Assoc 2011;142:310-204

What are my other finance options?

Early super release is intended as a last resort when you don’t have access to other sources of finance, such as savings, a loan or credit cards, but prefer not to delay treatment.

At Kelmscott Dental, we offer a range of flexible payment plans from trusted providers to give you more options for getting the funds you need right away with manageable repayments. Read more about our finance options below and contact our team to find out which plan could be a good fit for you.

Zip

Zip payment plans can cover All-on-4® costs from $1,000 to $30,000, with no upfront payment needed and interest-free terms available.

Afterpay

An Afterpay plan breaks down your treatment cost into four equal instalments paid over six weeks, interest free. The first instalment of 25% is paid on the day of your treatment.

Pretty Penny Finance

Pretty Penny Finance offers customisable dental loans from $5,000 to $80,000 over 1 to 7 years with same day approval.

Health funds

All-on-4® implants aren’t covered by private health insurance, but you may still be able to claim some items of your treatment on your health fund, depending on your level of cover. We recommend speaking with your health insurance provider to find out what you’re eligible to claim. Kelmscott Dental is a Bupa Members First Ultimate provider and a HBF Members Plus Dentist, but we also accept all other health funds.

Is early super withdrawal worth it?

If you have no other means of paying for All-on-4® implants, early super withdrawal may provide access to treatment when other options are not available, but it is a significant decision that should be carefully considered.

On the positive side, you may be able to access funds at a time when you urgently need them to restore your teeth. On the downside, any early withdrawal from your super is counted as part of your income for the year and is taxed. Depending on how much you take out, it could also affect your eligibility to receive Centrelink payments. Over time, it may mean you have less money available for retirement.

Speaking to a financial advisor could help you to explore all options and understand how making a withdrawal today could impact on your future finances. Read more about seeking financial advice.

If you want to know more about accessing super funds to pay for All-on-4® dental implants in Perth, contact our friendly team at Kelmscott Dental today. Call (08) 9495 7999 or book a consultation to discuss your needs with our dentists and find out what your options are. We welcome patients from all nearby suburbs, including Armadale and Gosnells.

References

- Malo P, de Araújo Nobre M, Lopes A, Moss SM, Molina GJ. A longitudinal study of the survival of All-on-4® implants in the mandible with up to 10 years of follow-up. J Am Dent Assoc 2011;142:310-204

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/withdrawing-and-using-your-super/early-access-to-super/access-on-compassionate-grounds/access-on-compassionate-grounds-what-you-need-to-know